December 11, 2024

Stronger US dollar under Trump 2.0 – what are the impacts on emerging and developing markets?

Earlier last month, Donald Trump made a remarkable political comeback by being re-elected as the 47th President of the United States. As the Republican party have also managed to maintain control of the US House of Representatives while gaining control of the US Senate, the incoming Trump administration will have significant influence over the US policy agenda during the next two-year cycle.

Crucially, Trump’s views around tariffs and fiscal policy have dominated headlines in recent weeks given the potential ramifications that it could have for the US Dollar, and more broadly, the global economy. Naturally, this has sparked our interests here at Finnfund around how risks and opportunities to investing in emerging market and developing economies (EDMEs) could evolve once he takes office.

This blog post is based on the Finnfund’s internal Lunch and learn session held in December 2024.

While the dollar is overvalued, its dominance will likely continue

Although Trump has always shown a preference for a weaker dollar to boost the competitiveness of US exports, it’s clear that the market has sensed that the more likely outcome is that his policies could have the opposite impact – much like what was the case during his first term.

There are growing risks that the dollar – which is already expensive from a historical standpoint – becomes even more overvalued due to the policies that he is advocating for.

The US’ relative economic momentum is a crucial driver for the dollar

While there are several factors that cause short term fluctuations in the dollar, its cycles over the longer term are always a reflection of shifts in relative momentum between the US and its largest economic counterparts, namely Europe and China. When economic momentum in the US strengthens relative to its large counterparts, the dollar typically rises, while the opposite is true when the US economy loses its relative momentum.

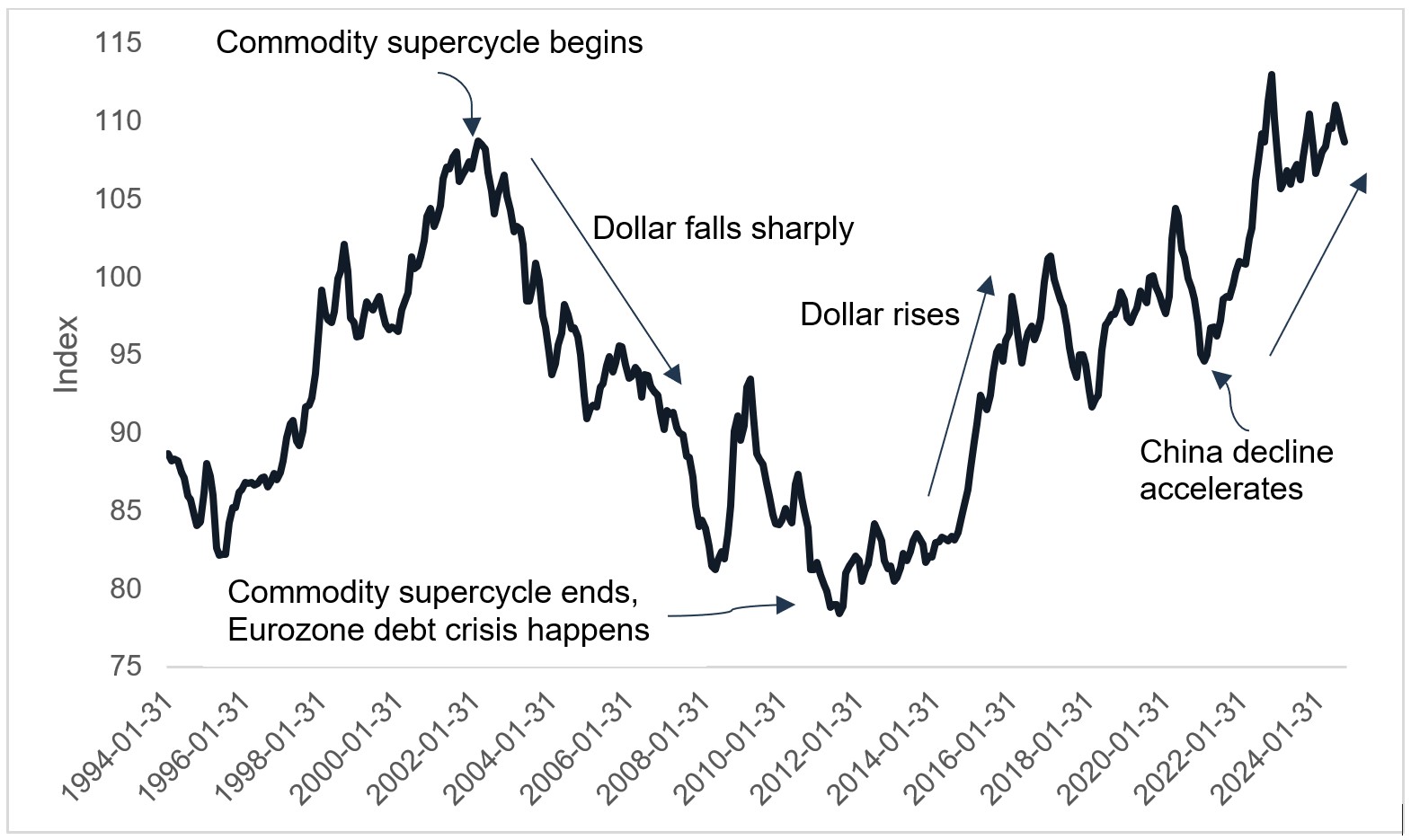

We can see how these cycles have played out historically in Chart 1, where China’s accession to the WTO in 2001 set the stage for a commodity supercycle, leading to a sharp decline in the dollar and fueling rapid growth in China and EDMEs over the decade that followed.

After 2011, the balance of power shifted back into the US’ favour post the Eurozone crisis and more recently with China’s economic decline, which has since resulted in an extended period of dollar dominance.

Chart 1: US Real Effective Exchange Rate, 1994–2024. Source: Bank of International Settlements (2024)

Trump’s tariff and fiscal stance will be central to the dollar’s strength

With this is in mind, there are two key factors which suggest that the dollar’s dominance will continue under Trump’s second term. The first (and most obvious) impact will result from his tariff proposals, as the market’s response would force other currencies to depreciate as a counterbalance to the dollar-price increase of imports into the US from the tariff increment.

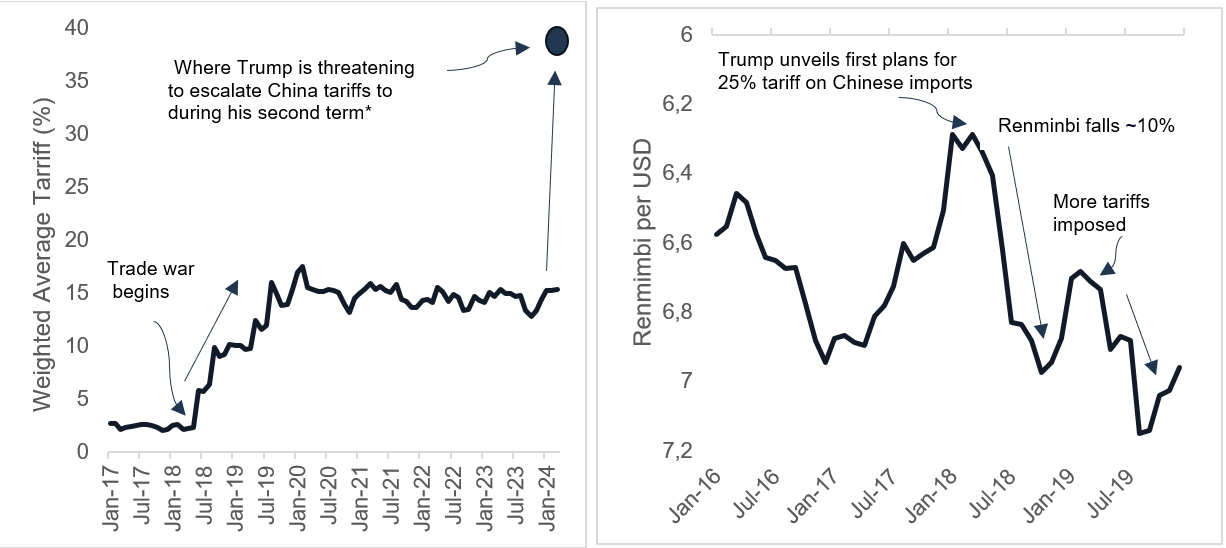

When looking specifically at China’s experience during 2018–2019, Chart 3 illustrates this dynamic, as its currency fell around Trump’s key tariff announcements on the Chinese economy. Many of the currencies in our markets were indirectly impacted by this – most notably in South-East Asian economies which are deeply integrated with China for trade, as well as in commodity-sensitive producing nations (such as the South African Rand, Chilean Peso and Brazilian Real) which are also heavily reliant on China as an export market.

Secondly, Trump’s fiscal thrust could also contribute to sustained dollar strength as his proposal to expand on the tax cuts he introduced in 2017 will allow inflationary pressure to build in the US, creating the risk of a more gradual interest rate easing cycle across the world.

Chart 2 (left): Average Tariffs on Chinese imports into US Trump 1.0. *Scenario assumes 60% tariff applied to lists 1-4. Source: US Census Bureau, WITS

Chart 3 (right): Chinese Renminbi vs US Dollar during. Source: Bank of International Settlements (2024)

Many markets are more prepared this time around

On the positive side, we believe that some of our markets could be more resilient to a sustained period of dollar strength this time around compared to the first iteration of the US-China trade war. Notably, our markets in South-East Asia (such as Indonesia, Thailand, Vietnam, and the Philippines) have managed to build up substantial external buffers in recent years, which will provide their currencies with some insulation against the dollar’s pressure.

Although Trump has flirted with the idea of broad-based tariffs on all imports into the US, many of his cabinet picks suggest that a more likely outcome would be a moderate increase in tit-for-tat tariffs between the US and China, with few (if any) targeted tariffs being imposed by the US on other countries. In this scenario, South-East Asian exporters would stand to benefit from rising demand for their products to the US as their competitiveness (relative to China) improves.

In addition, markets that are closer in proximity to the US, notably those across Latin America, could also benefit considering that US firms would be further incentivized to reshore their production away from China and closer to home for de-risking purposes.

Fiscal risks will put the dollar’s strength into focus within Sub-Saharan Africa

While debt sustainability concerns have risen across several of our markets in Sub-Saharan Africa, our views on fiscal outcomes (and thus, the risks associated with investing in these countries) remains heterogenous across the region.

In particular, a stronger dollar would place less pressure on funding costs in countries such as Cote D’Ivoire or Tanzania, where fiscal risks are relatively moderate, as they would in markets such as Ghana or Zambia. From our perspective, placing fiscal risks at the forefront of considerations to our investments in the region will be ever more important in navigating the headwinds that could arise from a stronger dollar over the next few years.

It remains to be seen whether Trump actually intends on following through with tariff pledges that he has made thus far. Irrespective of whether he does, we remain confident that the prevailing growth outlook, easing of monetary policy (though perhaps more gradual than previously expected) and attractive fundamentals will still bode well for investing in EDMEs over the medium term – potentially limiting the downside risks that his policies may have in many of our markets.

Economist